Risks and rewards are always changing in the complicated dance of finance. As hedge financing is a strategic move, a nuanced game that financial wizards use to stay on top of the constantly changing world. Let’s dive into the world of money moves and figure out the secret behind hedge financing.

Diversification as the Pillar of Hedge Financing

Imagine a financial chessboard where each piece addresses an alternate asset class. The trick behind hedge financing lies in the strategic placement of these pieces to create an expanded portfolio. Diversification is the pillar that upholds the whole construction, ensuring that the impact of a negative event on one asset is balanced by sure developments in others. It’s a delicate balance, a strategic dance that minimizes the impact of market volatility.

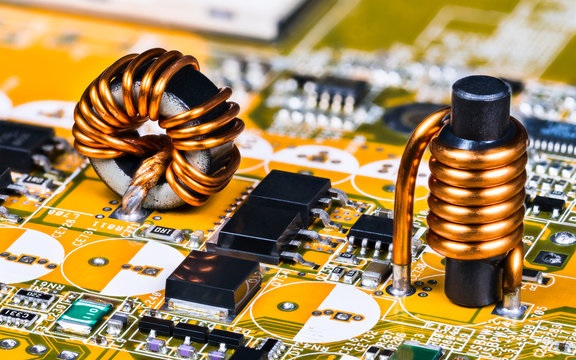

Derivatives and Risk Management:

Derivatives are the chess pieces in the intricate game of hedge financing. These financial instruments, for example, choices and fates contracts, allow investors to speculate on the future developments of asset costs. By strategically using derivatives, investors can hedge against potential misfortunes and manage risks effectively.

Market Timing and Tactical Maneuvers:

The trick behind quantitative hedge fund stretches beyond diversification and derivatives; it involves tactical maneuvers and sharp market timing. This dynamic approach guarantees that the financial chess pieces are not static but in constant movement, adapting to the always-changing landscape.

Balancing Act in the Financial Circus:

Each trick in the hedge financing playbook involves a delicate balance—a risk-return tradeoff that financial magicians carefully navigate. While the primary goal is to safeguard investments, keeping up with the potential for returns is equally essential. This balancing act requires a profound understanding of market dynamics, risk tolerance, and the ability to predict potential market shifts.

The Art and Science of Hedge Financing:

Fundamentally, hedge financing is both an art and a science. It’s the art of strategic positioning, anticipating market developments, and making calculated moves. Simultaneously, it’s the science of financial instruments, risk analysis, and fastidious planning. The trick lies in harmonizing these components into a symphony of strategy, where each note is played with precision to create a versatile and dynamic investment portfolio.

The trick behind hedge financing is a complex play that involves diversification, derivatives, market timing, and a careful risk-return tradeoff. It’s a strategic dance in the financial circus, where gifted entertainers utilize their expertise to navigate risks and reap rewards. Understanding this trick reveals the intricacy and finesse behind hedge financing, offering investors a brief look into the universe of sophisticated financial maneuvers.